The Insurance Shop, Inc. -

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

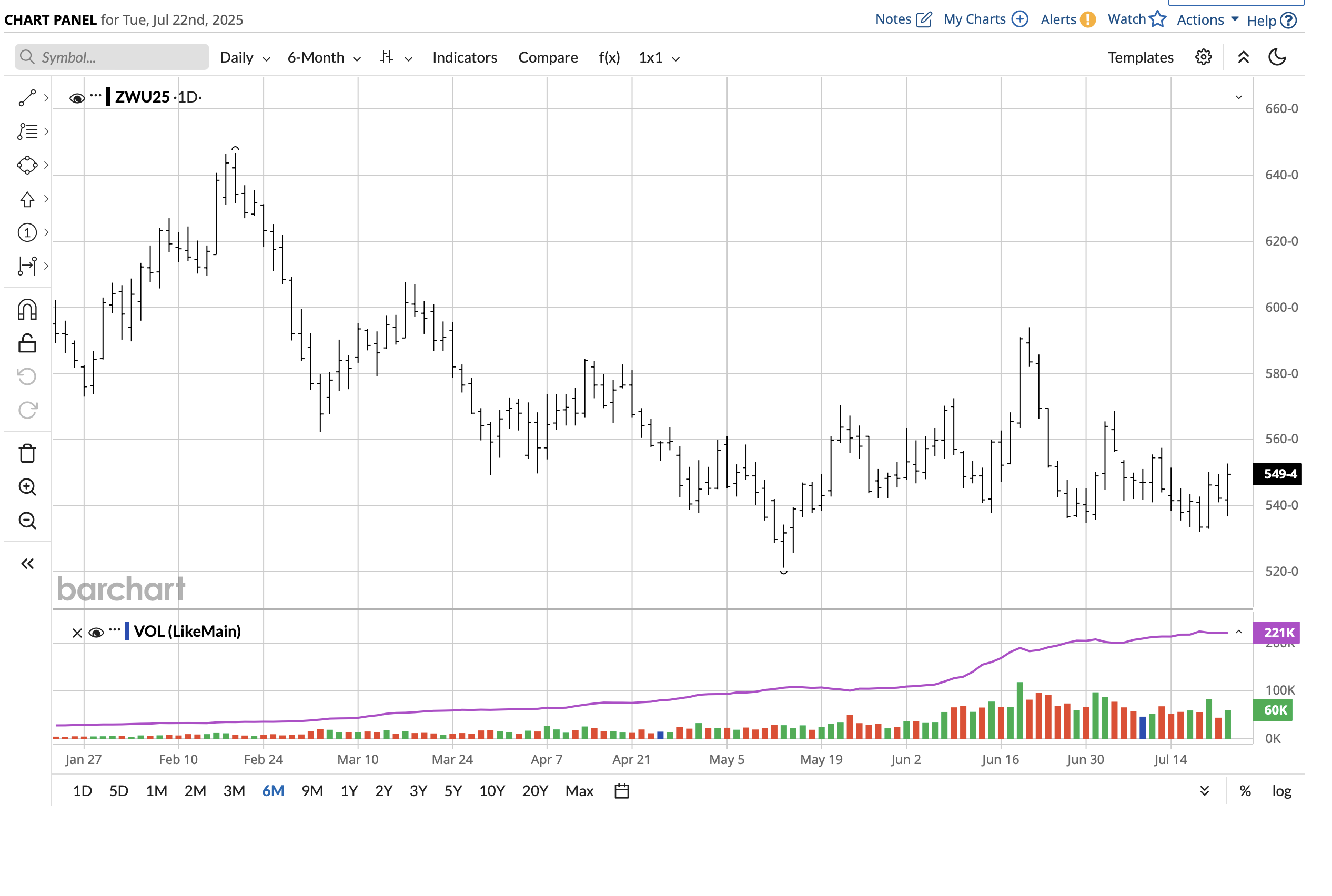

U.S. Wheat Making Headlines

I am Stephen Davis, senior market strategist, with Walsh Trading Inc. in Chicago, Illinois. The wheat market had a good start yesterday following reports that Bangladesh signed a five-year agreement to buy 700,000 tons of U.S. wheat each year. U.S. wheat exports for the 2025/26 marketing year are forecast to be 850 million bushels, up 25 million bushels from last month and the highest since 2020/21, according to the United States Department of Agriculture (USDA) Economic Research Service. This increase is driven by a strong pace of export sales and larger domestic supplies. Historically, a significant portion of Bangladesh's imports came from the Black Sea region, particularly Russia and Ukraine, due to lower costs. U.S. wheat prices are competitive and the deal provides a more stable supply chain while strengthening trade relations with the U.S. More headlines like this could help wheat trade higher. Meanwhile, Russia kept its wheat export tax at zero for the third week in a row due to expectations of a strong 2025 harvest and to boost Russian wheat exports after the harvest. This could increase competition in global markets and potentially lower prices. Romanian and Bulgarian wheat prices moved up to a one-month high last week. Perhaps U.S. wheat prices will follow suit. One futures trade strategy would be to buy September wheat now at today's settlement price of 549½ or better. Risk the trade to 539½ stop ($500 risk per contract). Profit objective is 569½. Maintenance margin on wheat is $1600. Risking one to make two is appealing, in my opinion. An option trade strategy would be to sell three September wheat 530 puts at 7.2 each. With this premium you bring into your account, buy one September wheat 590 call at 22 ½. So the three September puts that you sell will pay for the one September wheat you buy. The expiration date for the September wheat options is August 22. If wheat can rally in the next week or two, the September wheat options could be worthless. Then you can be long December wheat 590 the rest of the year.   If you want to discuss strategies, please contact me. Stephen Davis Direct 312 878 2391 Use this link to join my email list: SIGN UP NOW

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|